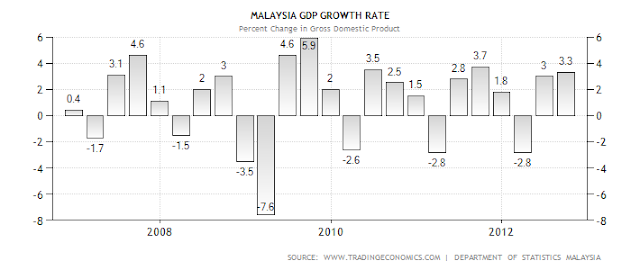

Based on the graph about Malaysia’s GDP growth rate, we can say Malaysia’s GDP growth rate is relatively average compared to other foreign countries. We can also see that in 2009, Malaysia had the highest and lowest GDP growth rate. In early of 2009, Malaysia has undergone the lowest growth rate of -7.6, but Malaysia regained its bearings and managed to get the highest GDP growth rate of 5.9 at the end of the same year.

Malaysia reported a Government Budget deficit equal to 5.30 percent of the country's Gross Domestic Product in 2011. Historically, from 1988 until 2011, Malaysia Government Budget averaged -2.89 Percent of GDP reaching an all time high of 2.40 Percent of GDP in December of 1997 and a record low of -7.40 Percent of GDP in December of 2009. Government Budget is an itemized accounting of the payments received by government (taxes and other fees) and the payments made by government (purchases and transfer payments). A budget deficit occurs when an government spends more money than it takes in. The opposite of a budget deficit is a budget surplus.

So in order to overcome the budget deficit, the government should implement the contractionary fiscal policy where government spending decreases and the tax rates increases. But because the global economy is weak, the government can't cut down on spending in order to support the country's economy but instead they should have spent it with limits.

So now, with Budget 2013, the government will reduce the budget deficit and extend spending on welfare and infrastructure projects to bolster domestic demand, the Ministry of Finance said as the country’s next general election nears. They will be extending reinvestment allowance and reducing income and corporate tax which is given to encourage companies to reinvest for the purposes of expansion, automation, modernisation or diversification of their existing businesses into any related products in the same industry.

Another way is by the

Monetary Policy. Monetary policy is defined as the Central Bank using some

instruments to influence the economy through the money supply and interest

rates. Through this policy, with the unemployment rate and recession increasing

in 2009, Bank Negara Malaysia might have influenced the GDP by decreasing the

interest rates. With interest rates dropping, aggregate expenditure on

investment and interest-sensitive consumption goods increases causing real GDP

to grow.

But how do they decrease the interest rates?

- By buying bonds. When the government buy bonds it increases the size of bank deposit, meaning money supply increases. Because money supply is high, interest rates will eventually fall and this increases purchasing power.

- By decreasing the reserve requirement ratio. Required reserve ratio is the percentage deposits that the central bank requires a bank to hold in vault or on deposit. It influences how much money the banking system can create with each dollar reserve. By decreasing the ratio, it will increase the money supply of the bank and lower interest rates.

- By lowering discount rates. Discount rates refers to the interest rate on the loan that the Central Bank makes to banks. When the rates decreases, the interest rates on loans decreases as well. Thus, more people are able to apply for loans and the purchasing power will rise.

Monetary Policy

The Prime Minister also came up with Budget 2013 whereby Budget 2013 has allocated RM 251.6 billion for the implementation of development projects with the focus on the well-being of the people.

The government came up with the programme "My First Home Scheme" whereby young married couples will be able to apply for a joint loan that is set at RM 10, 000 per month. People could now get housing loans from banks with much ease compared to before.

The government has also reduced individual income tax by 1% for changeable income for those earning RM 2, 500 and RM 50, 000. The next step that the government will take is introduce "Government Service Tax" which could help the government ease the country's debt and will not burden all Malaysians as lower income group are not required to pay it.

Through Budget 2013, government will invest to satisfy individual or collective needs of the members of the community and also develop the country's economic and performance for the reason of increasing GDP growth.

The Economic Transformation Programme

The

Economic Transformation Program is an initiative by the Malaysian government to

turn Malaysia into a high income economy by the year of 2020. This program is to aim Malaysia towards achieving an annual GDP growth of 6% until 2020 to meet

its target of becoming a high-income nation. Datuk Seri Najib Tun Razak

said such a rate of growth was needed for Malaysia to raise its per capita

income from the current US$7,000 to at least US$17,000 by 2020 to qualify as a

high-income nation under World Bank classifications.

Based on statistics, 6% annual growth is not easy to achieve and what more for a country with an economy that is more dependent on

external trade than domestic consumption and recent global crisis saw manufacturing activity fall dramatically and that affected both employment and growth rate.

Policy reform is required to get private sector investments in, especially with the number of competing nations for investment money growing from the days when Malaysia used to be a huge recipient of foreign direct investment.

It was also mentioned by RAM Holdings Group Chief economist Yeah Kim Leng, that the productivity growth rates have to increase from 1% to 1.5% yearly in order to maintain investment to GDP rates at 30%.

All in all, Malaysia's GDP is growing but at a slow rate and with the target to reach 6% annual growth, will we be able to achieve it or not, who knows. We'll just have to wait and see how our country will progress for the coming more years.

Reference:

http://biz.thestar.com.my/news/story.asp?file=/2009/11/10/business/5077262&sec=business

http://biz.thestar.com.my/news/story.asp?file=/2009/11/9/business/20091109113647&sec=business

http://useconomy.about.com/od/grossdomesticproduct/f/GDP_Components.htm

http://www.freemalaysiatoday.com/category/nation/2012/09/28/ensuring-economic-growth-continues/

http://www.tradingeconomics.com/malaysia/government-bond-yield

http://thestar.com.my/budget/

http://www.tradingeconomics.com/malaysia/government-spending

http://en.wikipedia.org/wiki/Economic_Transformation_Programme

How would inflation or unemployment affect the GDP?

ReplyDeleteInflation can affect the GDP. As we know, inflation is the rise in price of goods and services.

ReplyDeleteAs the price increase, this means consumers will have to spend more which they will avoid. So the consumers' spending will fall. As purchasing power falls, revenue of companies and corporate fields decreases and they will have to decrease the production. The country will then have to rely on exporting goods which will increase the governments' spending. If the government continues to spend more and more the country will face a budget deficit whereby the governemnt's spending exceeds the tax collected.

Susequently, deflation will occur when inflation rates fall below 0% and that is will cause the GDP to fall.

Well analysed & written... Where can I find more articles like this (i.e. about Malaysia's GDP) ?

ReplyDelete